Crude futures for delivery next month tumbled $4 and change in New York Wednesday, marking their biggest decline in a month. The recession obsession being what it is, the selloff was taken as confirming poor prospects for U.S. growth and rising risks that Europe will melt down.

But what Wednesday's plunge actually shows is how the bankers and their buddies are having their way with the economy yet again. Financial types – starting with the big banks that so graciously lean on our tax dollars, but also hedge funds and asset managers that sell index funds and the like – have spent the past half decade or so flooding into commodities. These markets are supposed to serve producers and consumers, but lately have served as much as anything as a profit center for deep-pocketed speculators.

That mismatch helps to explain why the price of crude oil, which is broadly driven by slow-moving global supply and demand trends, has been whipping around so viciously. Yes, demand is rising and supplies are on the tight side, but let's face it, the global economy looks more or less the same now as it did at this time last year.

Yet the price of London-traded Brent crude has risen by half in the meantime, to a recent $117. This is, needless to say, not a salutary development -- at least for those of us who buy our petroleum products by the gallon rather than the thousand-barrel contract.

Fundamentals? With the casino crowd in control, who needs 'em?

"What's going on in crude is just crazy," says Howard Simons, a strategist at Bianco Research in Chicago. "A 5% fall in the front-month futures contract in a day? How? Demand is certainly not going to fall that much between now and then, and supplycan't increase enough to justify it either."

The notion that the banks and other financial types have perverted commodity markets isn't a new one. A United Nations report released this month concludes that multiplying financial interests have pushed up prices and increased market volatility. The recent recovery differed from previous ones, the report says, in that the prices of oil and other goods rose in anticipation of, rather than in response to, rising demand.

This speculative shift exposes the global economy to false inflation shocks and overreacting central bankers (this means you, Jean-Claude Trichet).

The U.N. concludes that at the very least, regulators must enhance transparency in the markets for goods such as grains, metals and energy. They should also, needless to say, tighten regulation of big trading firms.

As it happens, the United States last year passed a law called the Dodd-Frank Act that aims to do these sorts of things, at least to some degree. But Americans like nothing better than stuff that is bad for us, so congressional Republicans are pushing back -- the banks have given us so much, after all! -- and regulators are putting off making the rules stand up.

Hey, why defuse the weapons of financial mass destruction when doing so would squeeze big political contributors' bottom lines?

"We have passed a 2,100-page law that can't even be enforced because no one can agree on how to do it," says Simons. "People are going to look at this and say, here's the gang that can't shoot straight."

The gang that may be able to shoot straight but chooses not to is the banks, which have spent the past year calling for big spikes and steep selloffs, often in the same breath. If you didn't know any better you might think this is the work of guys intent on goosing trading revenue at the expense of all else.

As always, the unshining example of this is Goldman Sachs (GS), whose commodities researchers have been freely revising their take on oil price trends much the way Sen. John Kerry used to change his vote on Iraq.

Goldman was telling clients to buy oil futures last fall as the Fed-fueled rally in riskier assets started. It then warned in April that the rally was overdone – before changing again in May with a call for a new spike.

This spin-like-a-top routine is particularly notable because Goldman is the E.F. Hutton of Wall Street oil desks. It can say practically anything and people will listen.

"It's just irresponsible to know you have that sort of influence and go throwing it around that way," says Dan Dicker, a longtime oil trader whose recent book, Oil's Endless Bid, shows how financial firms have changed the energy markets, and not for the better.

Dicker says the Pavlov's dog reaction to Goldman's many oil calls illustrates a concept that plays prominently in the U.N. report – the "intentional herding" that takes place when traders latch onto a new price trend. The herding tends to unmoor prices from fundamentals, giving producers and consumers false signals and distorting investment decisions. That means gains for traders who get in early enough -- at the expense of the rest of the economy. Your tax dollars at work.

This results in, among other things, gasoline at $3.80 a gallon at a time when "there is no good economic reason for the oil price to be as high as it is," Dicker says.

That arrangement is undeniably bad for you and me. But you could swear that what Congress cares about is what's good for the Goldman Sachs energy desk, and until we see oil at $180 a barrel or something who's going to argue?

"I don't see the political will to turn the tide on this," says Dicker. "The forces making money doing this are a lot stronger than the people trying to contain it."

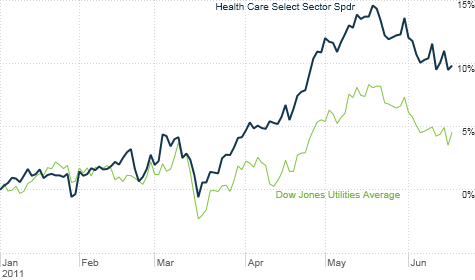

The broader market has pulled back on economic fears about the United States and Europe. But drug stocks and utilities have held up relatively well.

The broader market has pulled back on economic fears about the United States and Europe. But drug stocks and utilities have held up relatively well.